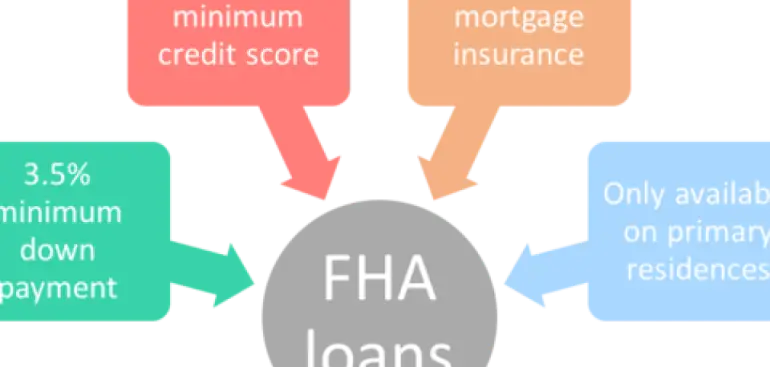

If you have an FHA loan, you may be getting tired of paying mortgage insurance every month in addition to your house payment and property taxes. There are so many advantages to FHA loans, but they do require you to pay mortgage insurance, sometimes called MIP (Mortgage Insurance Payments). On a conventional mortgage, mortgage insurance can also be called PMI (Private Mortgage Insurance). Unlike your life insurance policy, MIP doesn’t protect your family if you should become ill or die. It protects your lender and the amount of money they have loaned for your home.

Can you remove mortgage insurance from an FHA loan?

If you paid less than 10% down payment on an FHA loan, you will pay mortgage insurance for the life of your loan. Part of the insurance is a one-time mortgage insurance premium, which is paid when you took out the loan. Usually, the lender will finance this one-time insurance payment as part of your loan. You’ll also continue to pay an annual mortgage premium based on the length of your mortgage.

FHA rules for mortgage insurance payments are complicated. If you got your FHA loan after June 3, 2013, and you made a down payment of more than 10% on a 15, 20, 25 or 30-year FHA loan, you are eligible to apply for cancellation of your mortgage insurance payment (MIP) after 11 years. For older FHA loans taken out before June 3, 2013, you will pay MIP up to 78% LTV based on your original purchase price. Older FHA loans with borrowers who paid more than 22% down never had a MIP requirement. You may be able to refinance your FHA loan with a lower MIP depending on your equity in the home. If you’ve missed a mortgage payment during your loan, you won’t be able to drop the MIP until or unless you refinance into a conventional loan. HUD and FHA can change these rules at any time at their sole discretion. So it’s best to reach out to an independent mortgage broker and home loan professional at California Platinum Loans for the most current guidelines as they relate to your specific FHA loan.

Can you refinance your FHA mortgage to eliminate MIP?

Another option for getting rid of mortgage insurance is refinancing the mortgage completely. You have many options for different home loan products which could not only eliminate your mortgage insurance requirement but could also provide you with lower monthly payments.

If you’re tired of paying mortgage insurance every month and you want to put the money to better use, contact a home loan professional today to learn your options for eliminating mortgage insurance on an FHA mortgage by refinancing your current FHA loan into a new conventional mortgage loan.

Source

https://themortgagereports.com/55984/get-rid-of-pmi-or-mip-mortgage-insurance-with-a-refinance