For many homebuyers and investors, particularly in the upscale California real estate market, choosing the right type of mortgage is a critical decision. Fixed-rate and adjustable-rate mortgages (ARMs) are two of the most popular options, each with its unique benefits and drawbacks. This blog explores these mortgage types to help you make an informed decision that aligns with your financial goals and market conditions.

Understanding Fixed-Rate Mortgages

A fixed-rate mortgage comes with an interest rate that remains constant for the life of the loan. This predictability makes it a preferred choice for those who value stability in their financial planning. The primary benefit of a fixed-rate mortgage lies in its consistency; your monthly mortgage payments remain unchanged, simplifying your financial planning and budgeting.

Pros:

- Predictability: Your interest rate and monthly payments remain unchanged throughout the loan term.

- Simplicity: Easier to understand and plan for, as there are no future rate changes to consider.

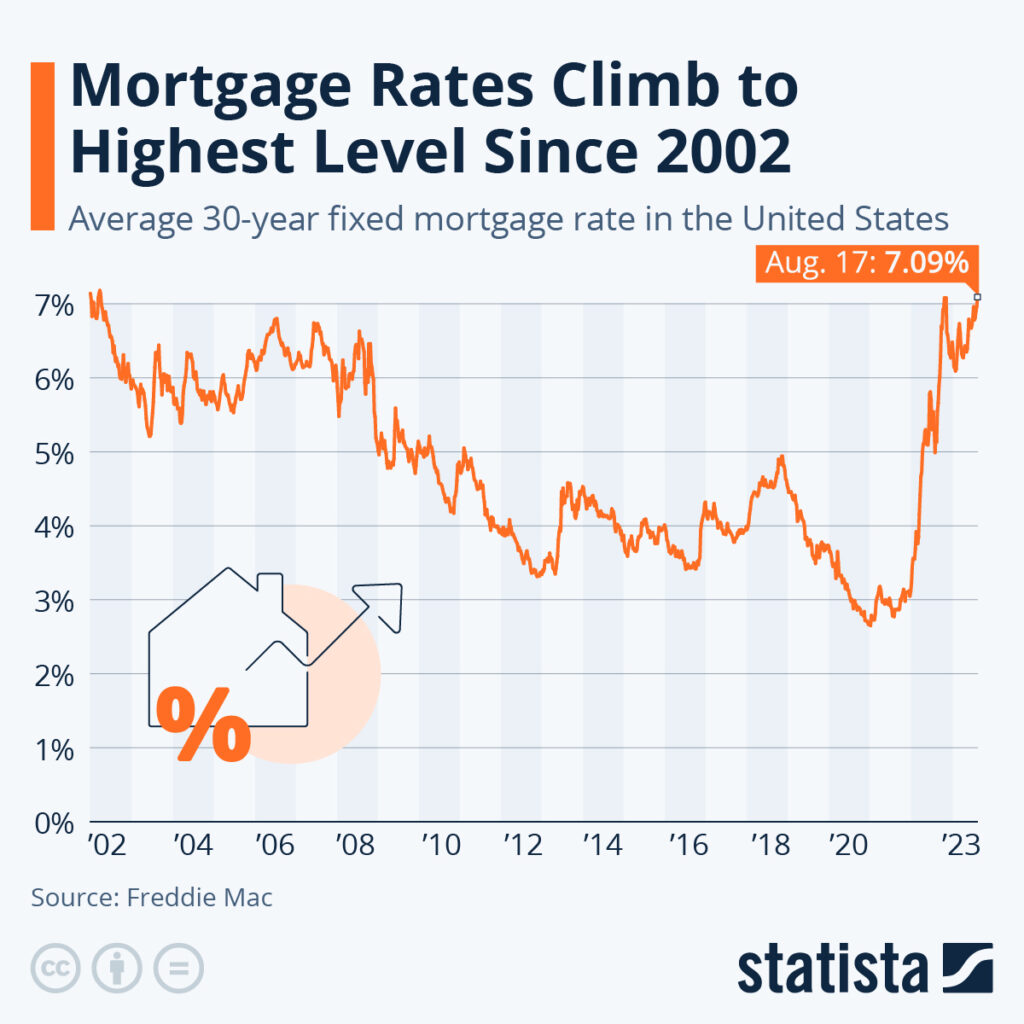

- Stability: Ideal for long-term planning, especially in a market with potentially rising interest rates.

Cons:

- Higher Initial Rates: Typically, fixed-rate mortgages start with higher interest rates compared to ARMs.

- Less Flexibility: If interest rates fall, you will only benefit if you refinance.

Delving into Adjustable-Rate Mortgages (ARMs)

ARMs begin with a lower interest rate for a predetermined period, after which the rate adjusts regularly based on market trends. This initial lower rate can be attractive, but the subsequent rate adjustments add an element of uncertainty.

Pros:

- Lower Initial Rates: ARMs often offer lower starting rates, leading to smaller initial monthly payments.

- Potential Savings: If interest rates decrease, your payments could go down without refinancing.

- Flexibility: Ideal for individuals who plan to relocate or refinance prior to the conclusion of the initial fixed-rate phase.

Cons:

- Rate Fluctuations: Your interest rate and monthly payments can increase over time.

- Complexity: ARMs can be more complicated to understand due to variable rates and market dependencies.

- Uncertainty: Not ideal for those who prefer consistent payments for budgeting.

Comparing and Contrasting: Making the Right Choice

A fixed-rate or an adjustable-rate mortgage hinges on various considerations, such as your current financial standing, the duration you intend to stay in the home, and your comfort level with financial risk. Fixed-rate mortgages offer stability and ease of understanding, making them suitable for long-term homeowners. On the other hand, ARMs can benefit those who plan to move or refinance in the near future or are comfortable with the risk of fluctuating payments. In the California luxury market, where real estate investments are significant, selecting the right mortgage type is crucial. A fixed-rate mortgage offers security and simplicity, whereas an ARM provides initial savings with variable future costs. Comprehending your financial objectives, staying informed about prevailing market conditions, and evaluating your risk appetite are key factors in determining the most suitable mortgage for you. Given the importance of such a financial decision, seeking guidance from financial advisors is advisable to confirm that your mortgage choice harmonizes with your broader investment plans.