One of the three big credit bureaus, TransUnion, predicts that there will be 8.3 to 9.2 million first-time home buyers between 2020 and 2022. This is almost 50% more new home buyers than 2015, and 25% more than 2017.

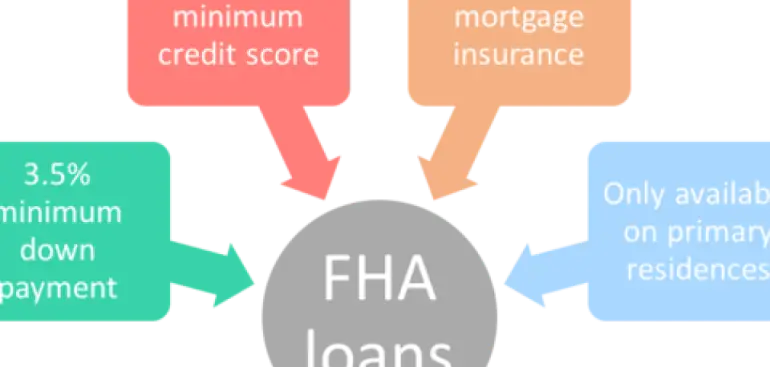

Where is the trend coming from? First, unemployment is low. More people have the opportunity to save money for down payments, and home prices aren’t rising quite as fast as they have been in recent years. Home loan interest rates, including on 30-year and 15-year fixed rate conventional, FHA, and VA mortgages, continue to be at low levels.

What do first time home buyers want in their first home?

The traditional view of a “starter home” leading to starting a family, then moving up the home-buying ladder isn’t as common as it used to be. Today’s first time home buyers are more interested in using home ownership as a wealth-building tool. They primarily see home ownership as a good financial alternative to paying rent. Some first-time home buyers may still be living with family or may be sharing housing. In this case, privacy and a place to call their own are the primary motivators.

What has delayed first time home buyers so far?

Student loan debt continues to be a challenge for many potential first time home buyers. Some buyers are waiting to get a better job or advance in their careers before making the move to buy a house. And still other first time home buyers aren’t aware of the variety of home loan options that are available to them.

Two thirds of the potential first time home buyers surveyed by TransUnion in 2019 said they hadn’t heard of either Fannie Mae or Freddie Mac, the two government-sponsored home mortgage enterprises that buy the majority of conventional mortgages issued by banks or other lenders. And a large number of first time home buyers still think they need perfect credit, a high income, and a 20% down payment to even consider buying a house.

If you’ve been thinking about buying a home for the first time, you’ll benefit from the help of an experienced home mortgage professional. California Platinum Loans can tell you what your options are and guide you through the process. You can join the new first time home buyers in taking advantage of good home buying conditions and low mortgage interest rates in 2020.